Artificial intelligence allows fund managers to collect and process data from multiple sources instantly, reducing delays and errors in reporting. Algorithms can automatically extract information from trading systems, regulatory filings, and internal databases, converting raw numbers into structured outputs that are easy to analyze. This real-time approach ensures that investors receive accurate, up-to-date insights into portfolio performance, market trends, and risk exposure, eliminating the inefficiencies of manual reporting and enhancing transparency across the investment lifecycle.

AI enables fund managers to customize the way information is delivered to different types of investors. Natural language processing and automated reporting tools can generate plain-language summaries for retail investors while producing detailed breakdowns for institutional stakeholders. This adaptability ensures that each investor receives the level of detail they require, improving engagement and comprehension. Interactive dashboards and notifications also allow investors to monitor portfolios on demand, creating a continuous flow of relevant information rather than relying on static quarterly updates.

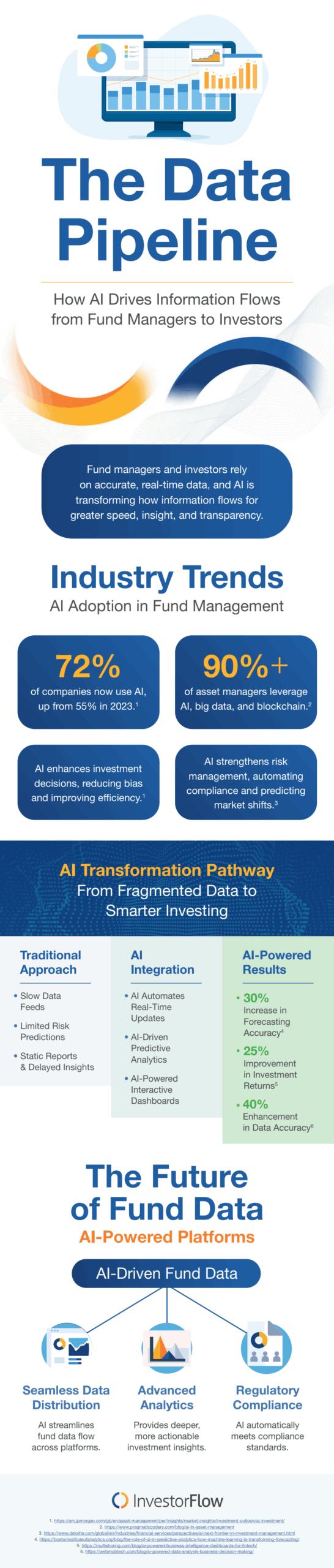

Beyond reporting, AI provides predictive analytics that anticipate investor needs and potential market shifts. Managers can highlight emerging risks or performance trends before questions arise, helping investors make informed decisions proactively. Integration with fund investor portal systems ensures that all communications, performance metrics, and documentation are accessible in one secure location. These AI-powered platforms streamline interactions, reduce administrative workload, and provide investors with reliable, timely information, creating a stronger connection between fund managers and their stakeholders. For more information, look over the infographic.